The renowned German insurance company, Allianz, has recently voiced its perspective on the European Union’s fresh regulations concerning data. According to an official statement, Allianz believes that there is a pressing need for additional regulations around the secure exchange of vehicle data. They advocate for a regulated market for such data exchanges.

Klaus-Peter Röhler, a board member of Allianz, emphasized the transformative potential of real-time vehicle data. He suggests that by harnessing millions of real-time data points from vehicle cameras and positioning systems, cities could potentially solve major parking issues.

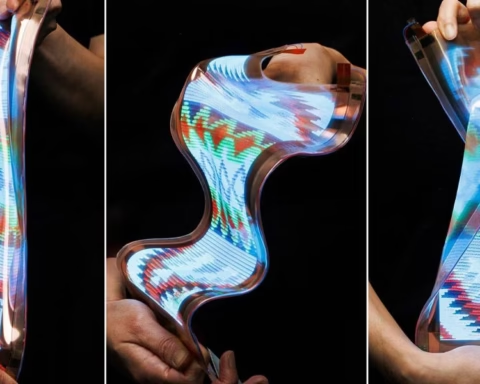

The newly introduced EU regulation aims to make data from connected vehicles available for the benefit of vehicle owners. This is expected to enhance road safety and pave the way for sustainable digital innovation. During the 11th edition of Allianz Motor held on 17 October 2023, experts from diverse fields related to the auto industry gathered at the Allianz Center for Technology in Ismaning to discuss this new regulation.

Röhler underlined the compelling principle of the new EU regulations: “My device, my data – we support this idea.” As per the latest provisions, connected vehicle users can request manufacturers to transfer their vehicle data to third parties. For easily accessible data, the EU Data Act even mandates real-time availability.

Allianz sees a plethora of innovative possibilities stemming from this. Röhler highlighted the potential of attracting auto insurance clients with enticing offers to share their vehicle data. Such real-time data could help alleviate parking problems in major cities, leading to energy conservation, better climate protection, and improved air quality. When used wisely, vehicle data can make transportation systems safer, cleaner, and smarter overall.

So, how does this change auto insurance? Allianz suggests that with detailed data from vehicles, entirely new insurance services and offers can be devised. Röhler gave the example of real-time damage assessment in the event of an accident, enabling Allianz to proactively assist clients, from towing services to medical aid. Moreover, auto data allows Allianz to offer tailored insurance quotes based on driving style, safety systems in the vehicle, and more.

He also pointed out the growing importance of vehicle data as autonomous systems and AI become more prevalent in controlling vehicles. In case of an accident, distinguishing whether it was caused by a human or machine becomes crucial.

A recent Allianz survey from five European countries revealed that a majority of drivers are willing to share their vehicle data with insurers in exchange for comprehensive assistance and services. For instance, in Germany, the willingness rate stands at 53%, while in the UK, it’s as high as 61%.

However, the EU’s data protection regulation currently provides just the legal foundation for transferring vehicle data to third parties. What’s missing, according to Röhler, is the legal framework specifying the technical means to make this vehicle data usable for all market players. Allianz is calling for:

- Complete transparency for vehicle owners about data collected from their vehicles.

- A standardized minimum dataset to allow new services regardless of the manufacturer.

- A regulated market and an independent data administrator to ensure secure data exchange.

- Fair prices for transmitting data to third parties.

Allianz sees this as an opportunity for everyone involved, from insurers to vehicle owners, to benefit from the numerous innovations ahead.

More info on Allianz news page: https://www.allianz.com/en/press/news/business/insurance/231017-allianz-vehicle-data-can-become-a-turbo-for-the-european-digital-economy.result.html/4.html